Mobile Payment Innovations

From purchasing groceries to splitting bills at a restaurant, mobile payments have made financial transactions more convenient, faster, and secure.

The Evolution of Mobile Payments

The journey of mobile payments began with the introduction of credit and debit cards, followed by the advent of digital wallets. Today, mobile payment platforms are leveraging cutting-edge technologies such as Near Field Communication (NFC), blockchain, and biometric authentication to offer seamless user experiences.

The Rise of Digital Wallets

Digital wallets, such as Apple Pay, Google Wallet, and Samsung Pay, have gained immense popularity in recent years. These platforms allow users to store card information securely on their smartphones, enabling them to make payments with a simple tap or scan. The convenience of not carrying physical cards has transformed how we perceive financial transactions.

Contactless Payments: NFC Technology

Near Field Communication (NFC) technology has been a game-changer in the mobile payment industry. By allowing devices to communicate wirelessly when in close proximity, NFC has enabled contactless payments. Consumers can now make quick and secure payments by simply holding their devices near a compatible terminal.

Innovative Technologies Driving Mobile Payments

Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies like Bitcoin and Ethereum are playing a significant role in mobile payment innovations. By decentralizing financial transactions, blockchain offers increased security, transparency, and reduced transaction fees. Mobile apps supporting cryptocurrency payments are becoming increasingly popular, allowing users to make global transactions with ease.

Biometric Authentication

Security concerns have always been a challenge in the mobile payment industry. To address this, biometric authentication methods such as fingerprint scanning, facial recognition, and iris scanning are being integrated into payment systems. These technologies ensure that only authorized users can access their accounts, enhancing security and user confidence.

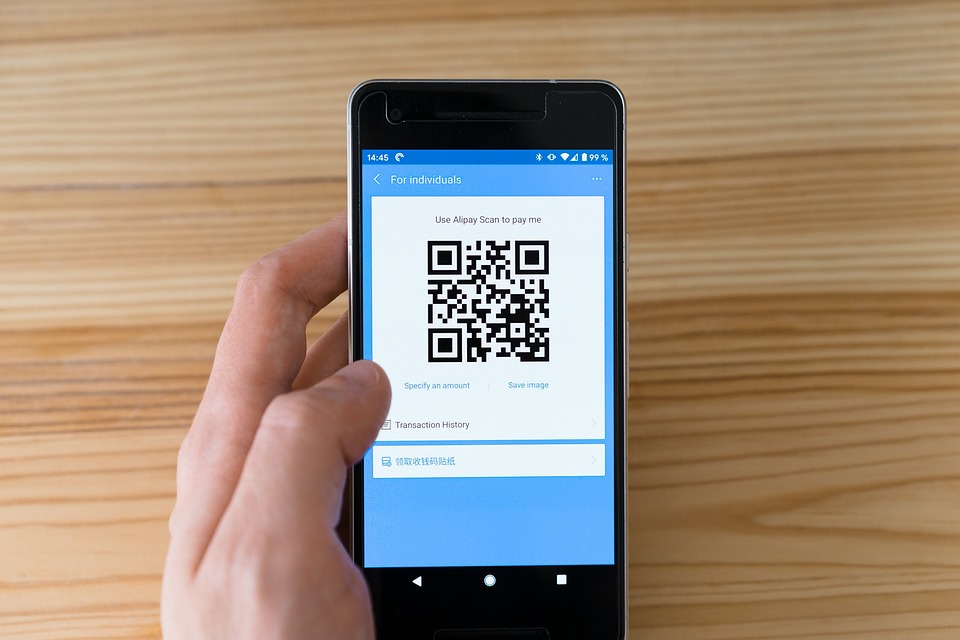

QR Code Payments

QR codes have become a preferred method for making mobile payments, especially in regions where NFC technology is not widely available. Users can simply scan a QR code displayed by the merchant to complete a transaction. This method is both cost-effective and easy to implement, making it popular among small businesses and street vendors.

The Impact of Mobile Payment Innovations

Consumer Convenience

Mobile payment innovations have significantly enhanced consumer convenience. With digital wallets and contactless payments, users can complete transactions quickly without the need for physical cash or cards. Additionally, mobile payment apps often offer features such as transaction history, budgeting tools, and loyalty rewards, empowering users to manage their finances more effectively.

Business Benefits

For businesses, adopting mobile payment technologies can lead to increased sales, improved customer satisfaction, and streamlined operations. By offering diverse payment options, businesses can cater to a broader audience, including tech-savvy millennials and Gen Z consumers who prefer digital transactions.

Financial Inclusion

Mobile payment innovations are also driving financial inclusion by providing access to banking services for unbanked and underbanked populations. In many developing countries, mobile payment platforms have become a primary method for people to save, send, and receive money, thus fostering economic growth and stability.

Challenges and Future Prospects

Security Concerns

Despite the advancements in mobile payment technologies, security remains a top concern. Cybercriminals are constantly developing new methods to exploit vulnerabilities. Therefore, ongoing research and development in security protocols are essential to protect user data and maintain trust in mobile payment systems.

Regulatory Challenges

As mobile payment technologies advance, regulatory frameworks must also evolve to address new challenges. Ensuring compliance with local and international regulations, such as data protection and anti-money laundering laws, is crucial for the sustained growth of the mobile payment industry.

The Future of Mobile Payments

The future of mobile payments looks promising, with emerging technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) poised to revolutionize the industry further. As devices become more interconnected, the potential for seamless, automated transactions grows, offering unprecedented convenience and efficiency.

Conclusion

Mobile payment innovations are undoubtedly transforming the financial landscape. By embracing these technologies, consumers and businesses alike can benefit from enhanced convenience, security, and financial empowerment.

As we look to the future, continued innovation and collaboration among stakeholders will be key to realizing the full potential of mobile payments.